A Comprehensive Guide to Weekly Profit and Loss Statements

Aug 22, 2023

A Weekly Profit and Loss (P&L) statement is a vital tool for businesses of all sizes. It provides a snapshot of a company's financial health by summarizing its revenues, costs, and expenses over a specific week. This valuable document helps business owners and managers monitor their financial performance and make informed decisions to improve profitability. In this article, we will explore the significance of weekly P&L statements, how to create one, and how to interpret the data effectively.

The Importance of Weekly P&L Statements

Real-time Insights: Unlike monthly or annual financial reports, weekly P&L statements offer real-time insights into your business's financial performance. This frequency allows you to identify trends and address issues promptly.

Immediate Decision-Making: With weekly P&L statements, you can make quick, informed decisions. For example, if you notice a sudden spike in expenses, you can investigate the cause and take corrective action before it affects your bottom line.

Cash Flow Management: Weekly P&L statements help you manage your cash flow effectively. You can foresee periods of low cash reserves and plan accordingly, avoiding potential financial crises.

Creating a Weekly P&L Statement

To create an effective weekly P&L statement, follow these steps:

Gather Data: Collect all financial data for the week, including sales revenue, cost of goods sold (COGS), operating expenses, and any other income or expenses.

Categorize Transactions: Organize your data into categories, such as revenue, direct costs, and indirect costs. This categorization helps you analyze specific areas of your business.

Calculate Gross Profit: Subtract your COGS from your total revenue to calculate your gross profit. This figure represents the money you have left after covering the costs directly associated with producing your products or services.

Deduct Operating Expenses: Subtract your operating expenses from your gross profit to calculate your net profit. Operating expenses include rent, utilities, salaries, and other overhead costs.

Include Non-operating Items: If applicable, include any income or expenses that are not part of your day-to-day operations, such as interest income or one-time expenses.

Account for Taxes: Deduct any applicable taxes from your net profit to arrive at your after-tax profit.

Interpreting Weekly P&L Statements

Once you have your weekly P&L statement, it's essential to interpret the data correctly:

Trend Analysis: Compare your weekly P&L statements over time to identify trends. Are your profits increasing or decreasing? Are expenses under control?

Budget vs. Actual: Compare your actual results to your budget or forecasts. This helps you pinpoint areas where you may be overspending or falling short of revenue targets.

Margin Analysis: Examine your gross and net profit margins. Are they in line with industry standards? If not, consider adjusting your pricing or cost structure.

Cash Flow Management: Pay attention to your cash flow. If you notice consistent negative cash flow, it may be time to revisit your financial strategy.

Identify Cost Drivers: Determine the main drivers of your costs and expenses. This can help you focus on cost reduction strategies.

Conclusion

Weekly Profit and Loss statements are essential tools for monitoring your business's financial health. They provide real-time insights, help you make informed decisions, and enable effective cash flow management. By creating and interpreting weekly P&L statements, you can better understand your business's financial dynamics and take proactive steps to improve profitability.

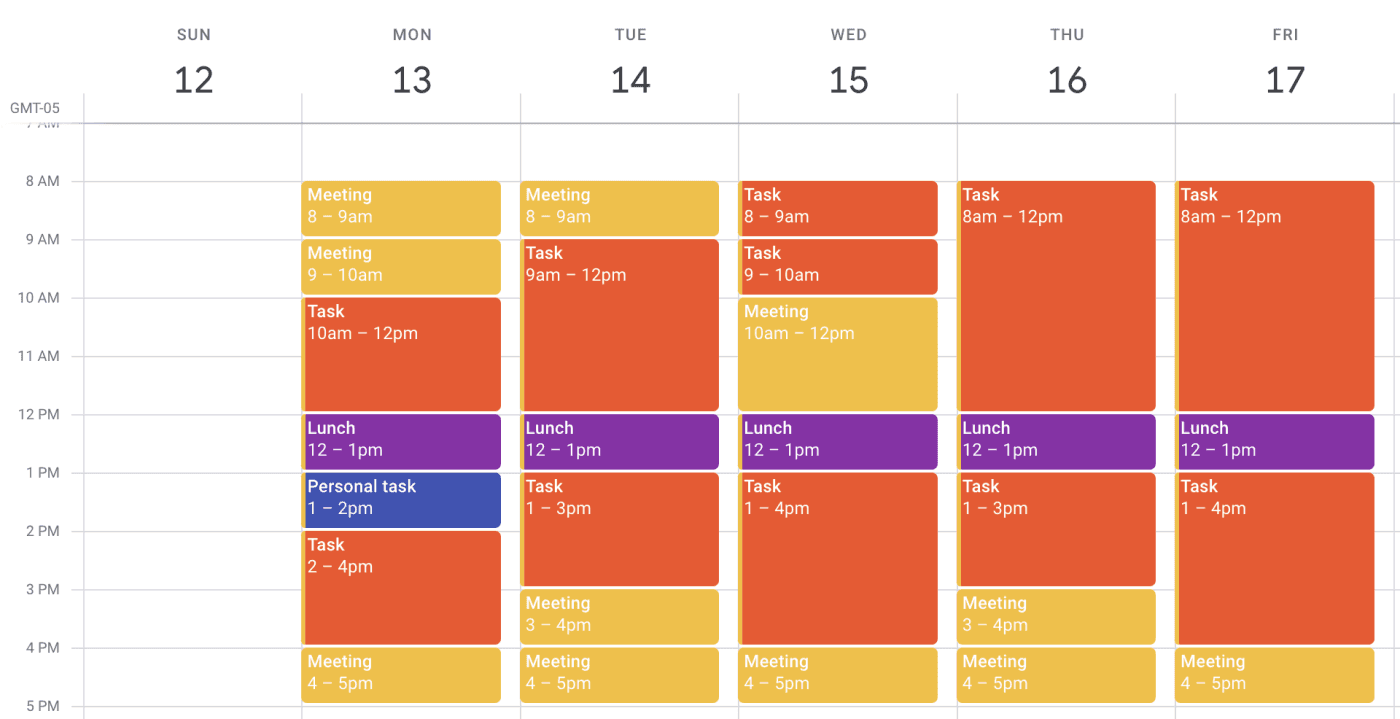

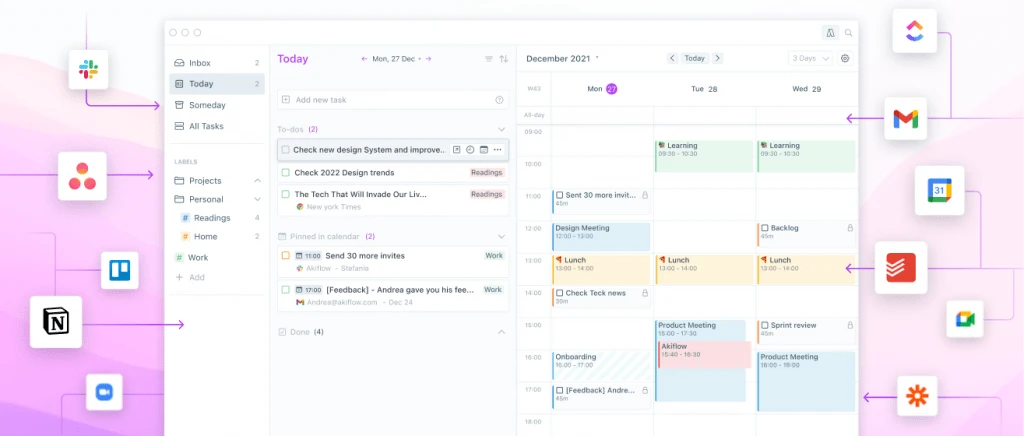

Your Trello, Asana, ClickUp, Todoist tasks

on Google Calendar.

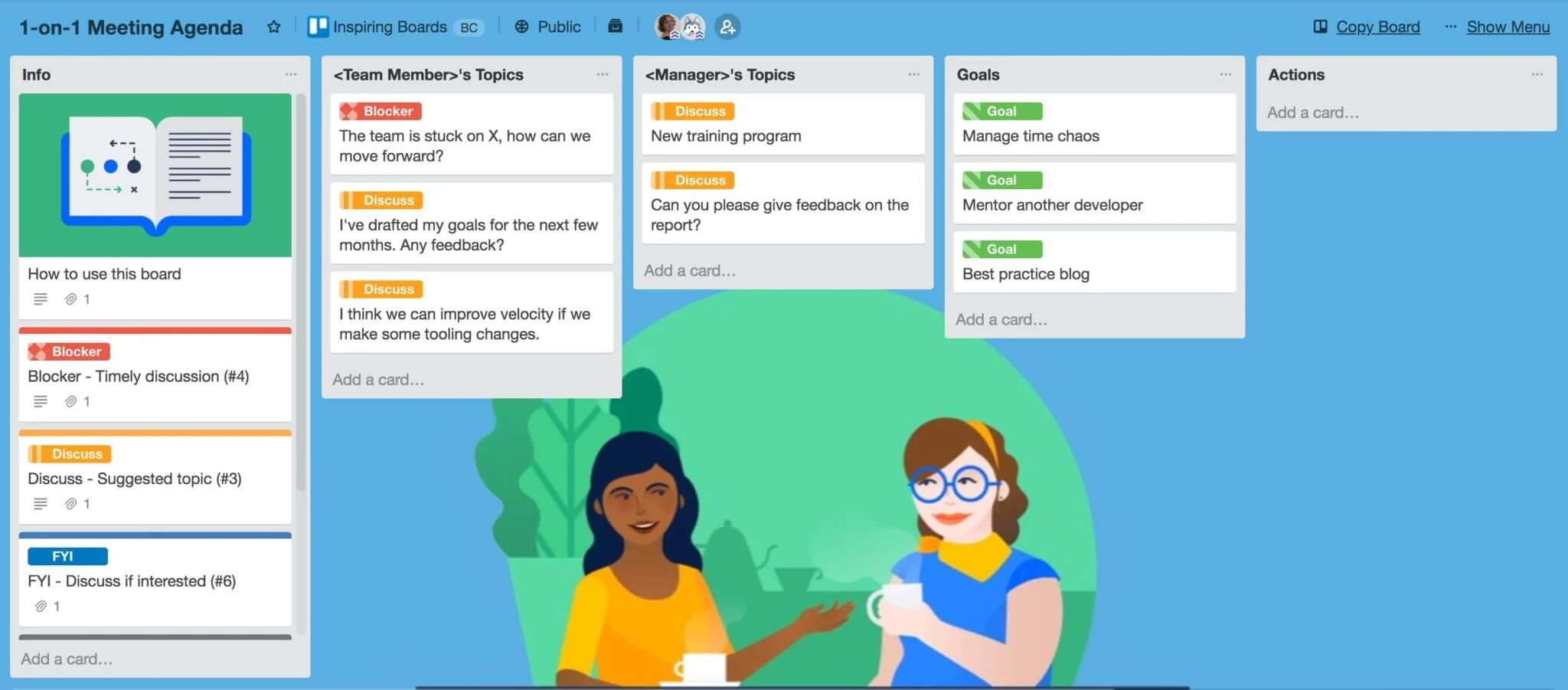

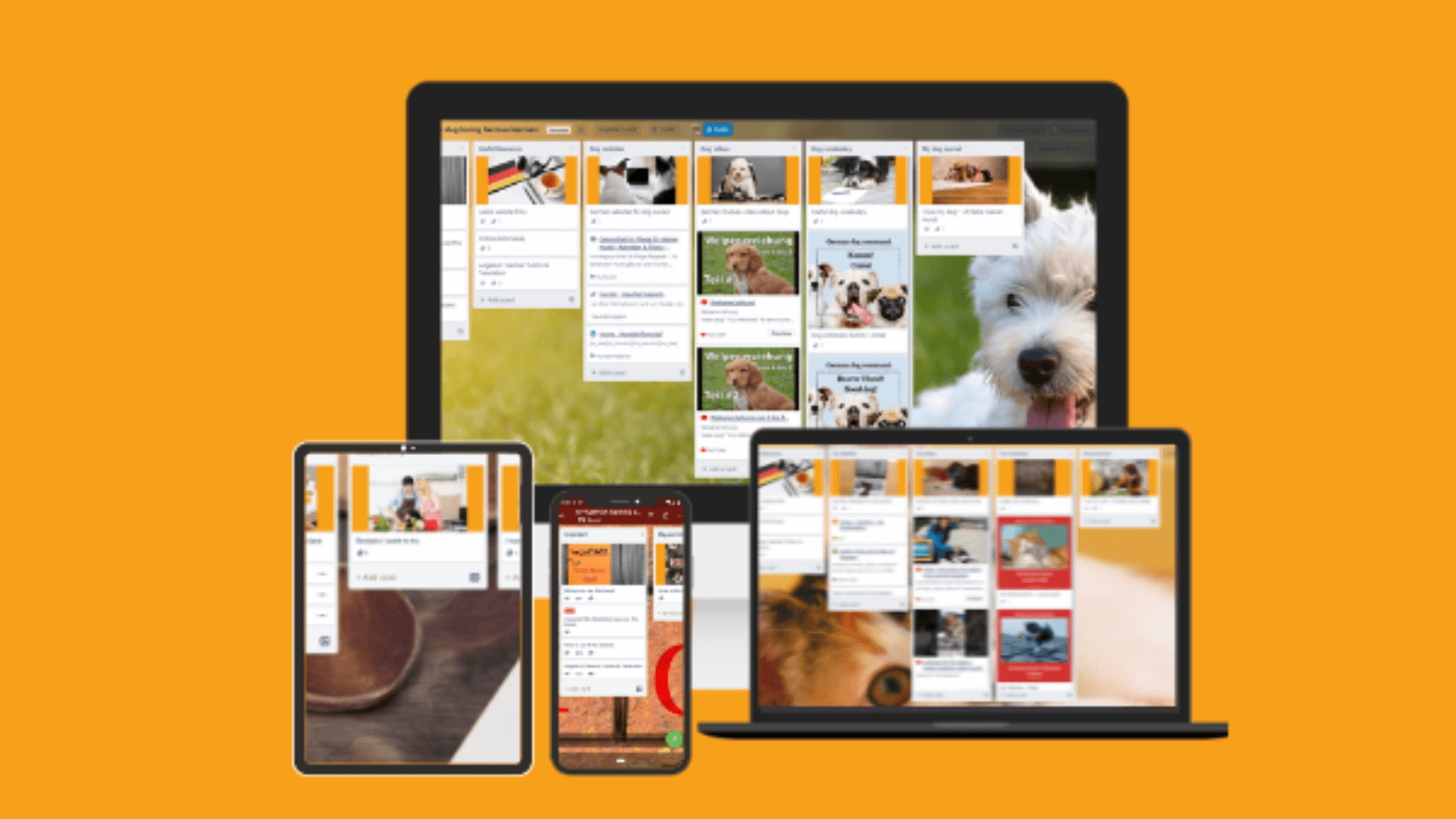

Visualizing Goals: Trello Boards for Long-Term Work Week Planning

Jan 1, 2024

Automation Hacks: Trello Integrations for Streamlined Workflows

Dec 31, 2023

Collaborative Planning: Enhancing Team Productivity with Trello Boards

Dec 30, 2023

Task Prioritization: Trello Strategies for a Productive Work Week

Dec 29, 2023

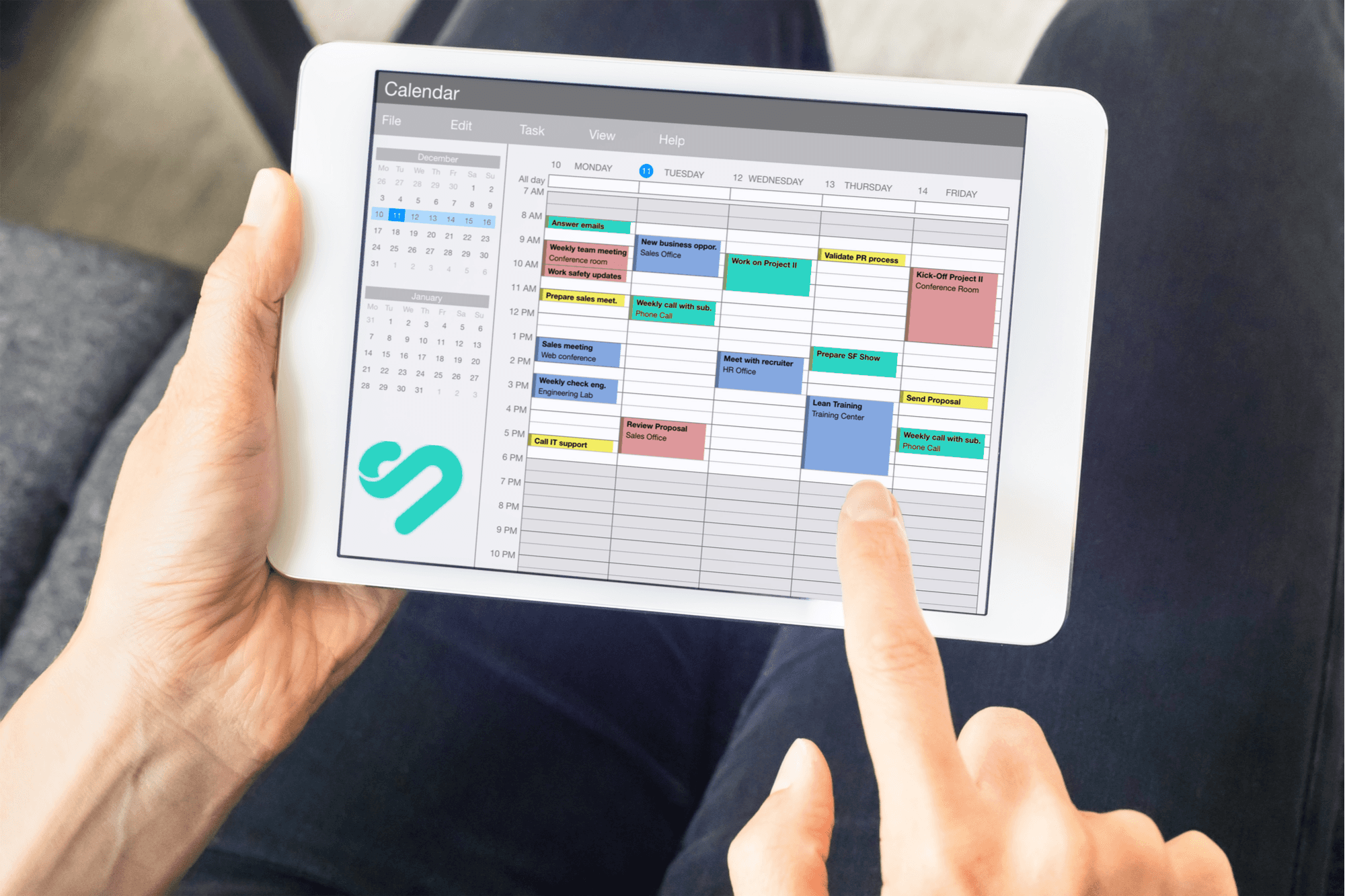

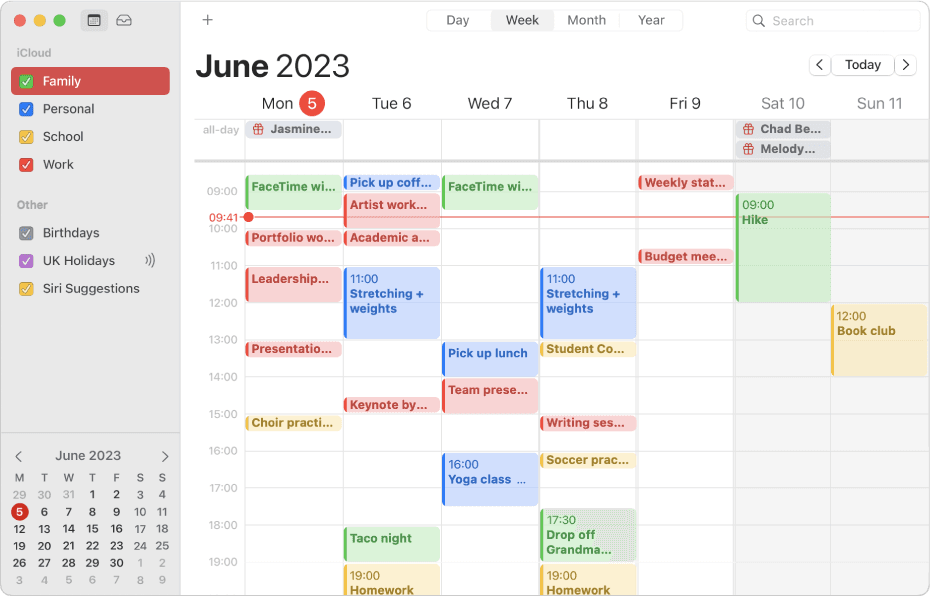

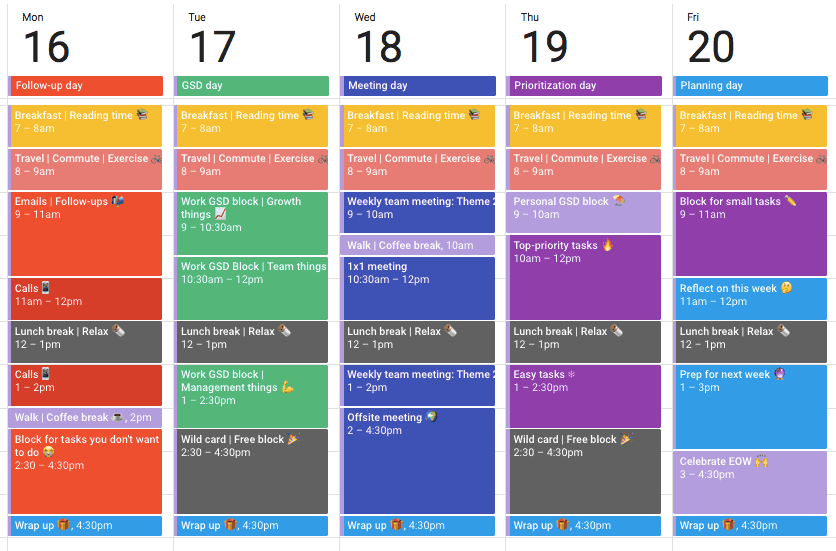

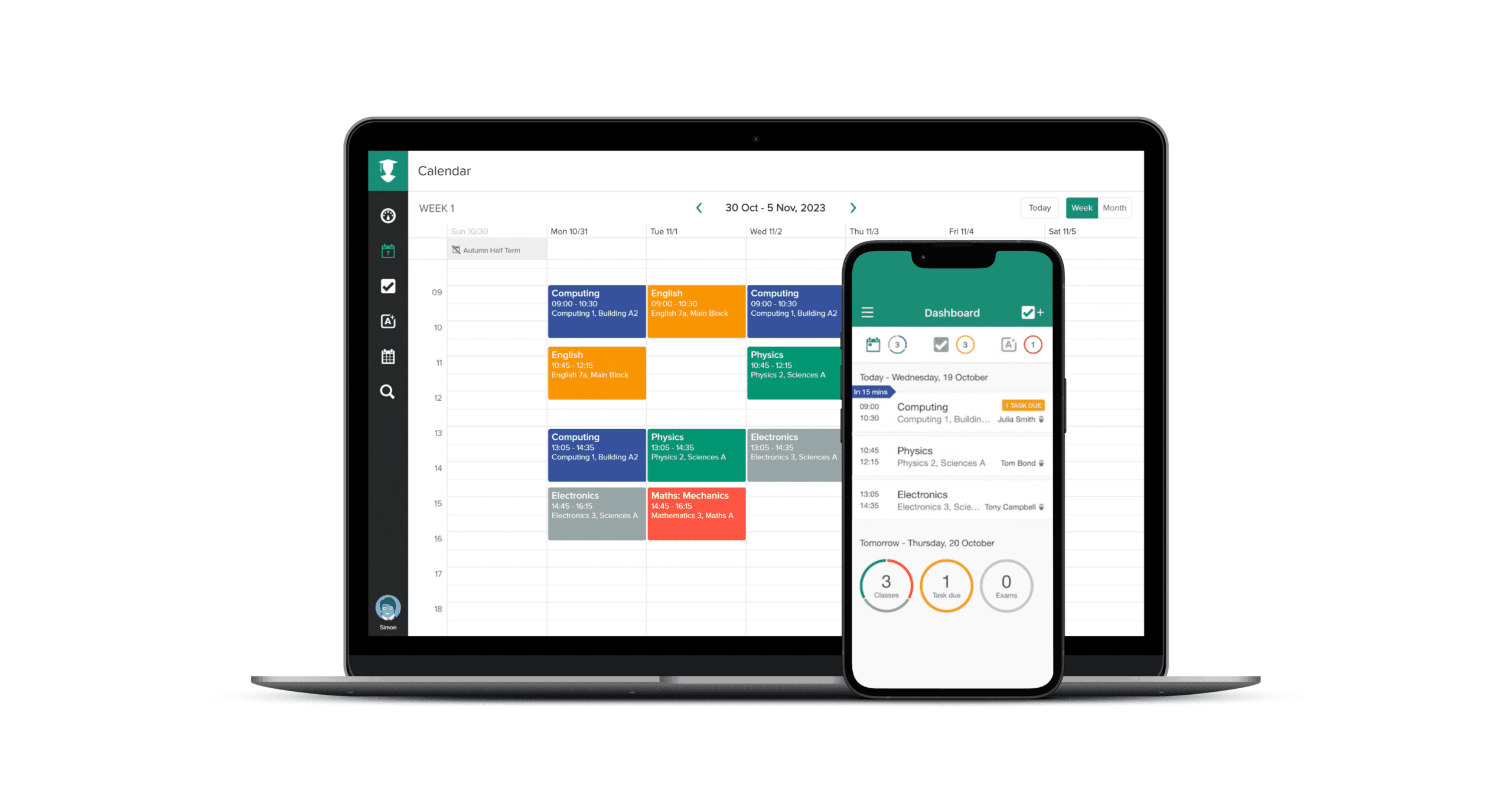

From Goals to Reality: Long-Term Planning with Google Calendar and Time Blocking

Dec 24, 2023

Optimizing Your Schedule: Google Calendar Apps for Enhanced Time Blocking

Dec 23, 2023

Collaborative Time Blocking: Using Google Calendar for Team Productivity

Dec 22, 2023

Balancing Work and Life: Time Blocking Strategies for Personal and Professional Harmony

Dec 21, 2023

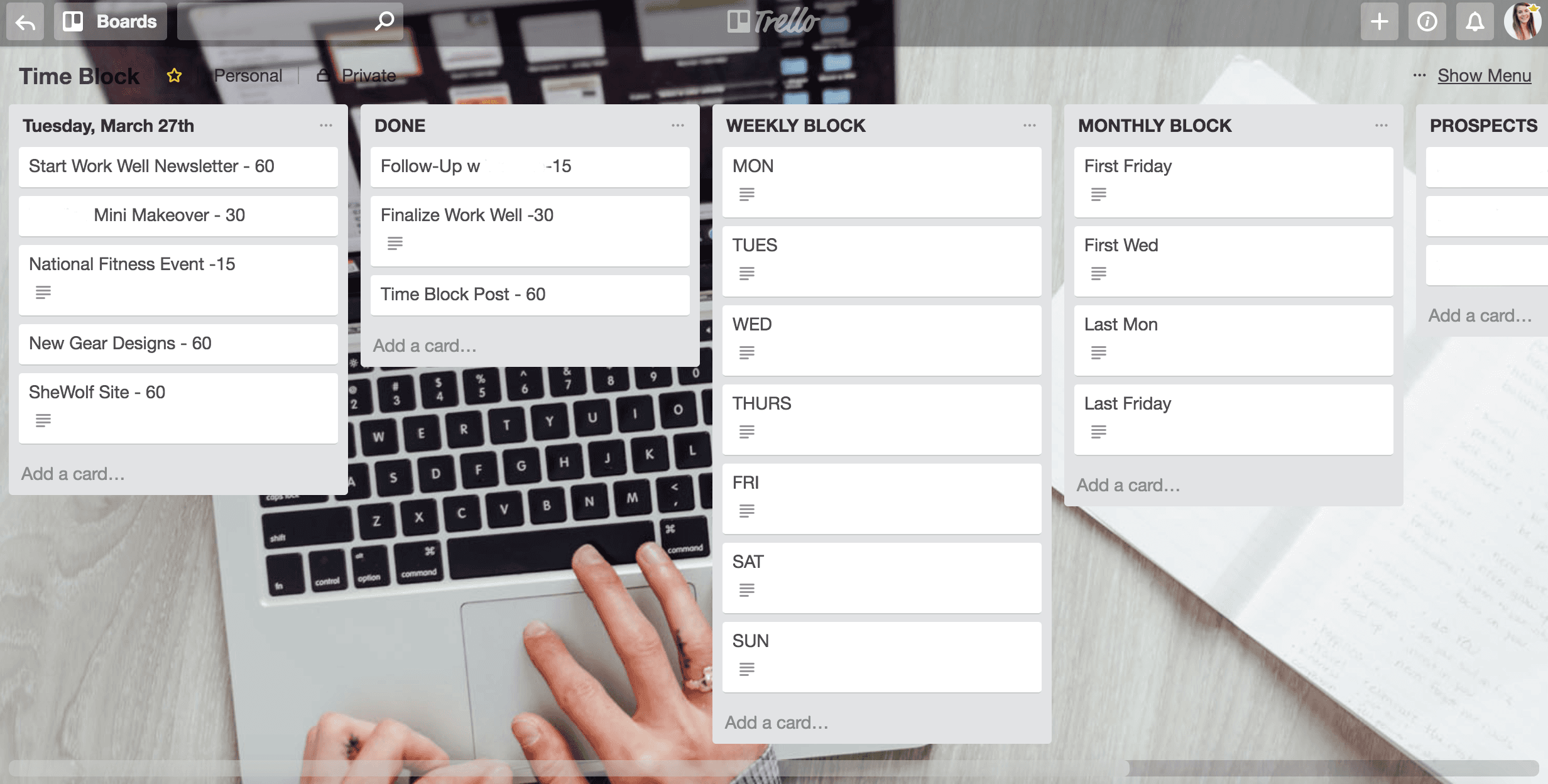

Time Blocking for Productivity: Google Calendar Tips and Tricks

Dec 20, 2023

Mastering Your Time: A Comprehensive Guide on How to Use Google Calendar for Time Blocking

Dec 19, 2023

Advanced Customizations: Asana and Google Calendar for Power Users

Dec 15, 2023

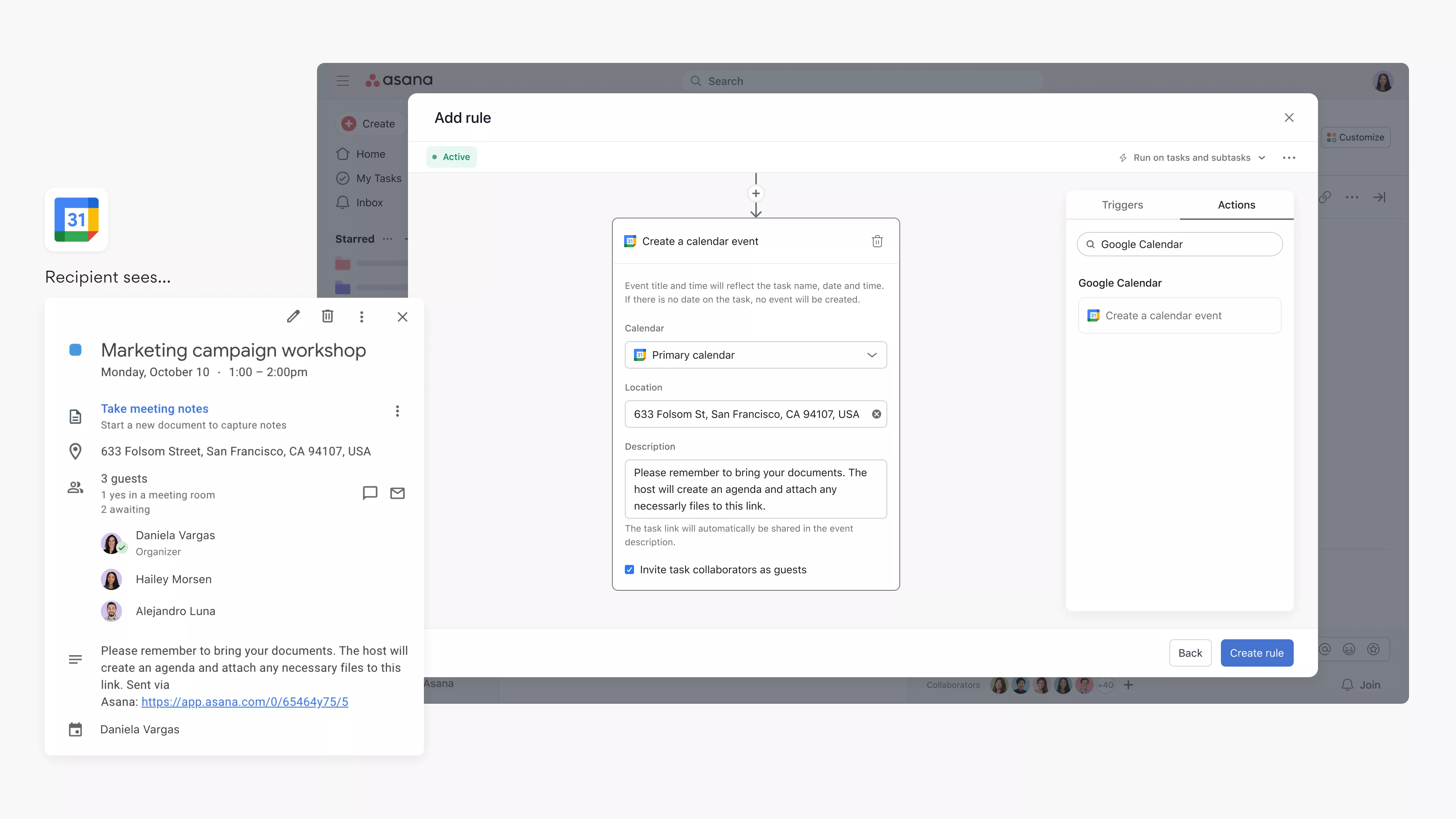

Automation Hacks: Asana Integrations and Google Calendar Efficiency

Dec 14, 2023

Team Collaboration Made Easy: Asana Projects and Google Calendar Events

Dec 13, 2023

Time Blocking Techniques: Asana Tasks and Google Calendar Synergy

Dec 12, 2023

Syncing Asana Due Dates with Google Calendar: A Comprehensive Tutorial

Dec 11, 2023

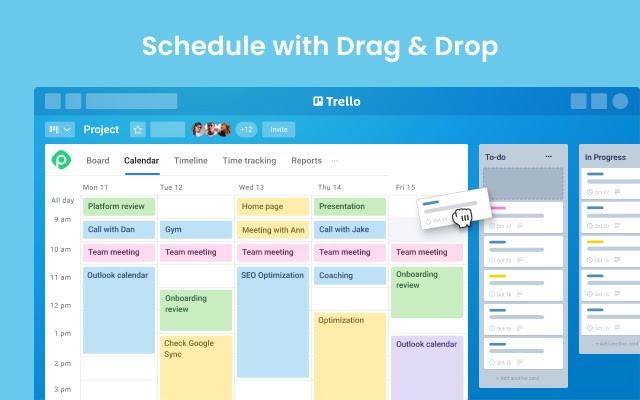

Advanced Customizations: Trello and Google Calendar for Power Users

Dec 10, 2023

Collaborative Project Planning: Trello Teams and Google Calendar Events

Dec 9, 2023

Time Management Strategies: Trello Boards and Google Calendar Harmony

Dec 8, 2023

Syncing Trello Cards with Google Calendar: A Step-by-Step Tutorial

Dec 7, 2023

Task Prioritization Strategies: A Todoist and Google Calendar Approach

Dec 6, 2023

Unlock Your Productivity with Advanced Features for Todoist and Google Calendar Power Users

Dec 5, 2023

Using Todoist and Google Calendar for Effective Collaborative Planning in Teams

Dec 4, 2023

Using Time Blocking with Todoist and Google Calendar to Enhance Productivity

Dec 3, 2023

Using Labels and Filters: Todoist and Google Calendar Synergy

Dec 2, 2023

How to Sync Todoist Tasks to Google Calendar Events

Dec 1, 2023

Integrating Todoist with Google Calendar for Effortless Scheduling

Nov 30, 2023

7 Free Trello Templates for Streamlining Workflow and Improving Productivity

Nov 29, 2023

Setting Goals that Motivate and Inspire Action

Nov 28, 2023

How to Integrate Todoist with Apple Calendar for Increased Productivity

Nov 27, 2023

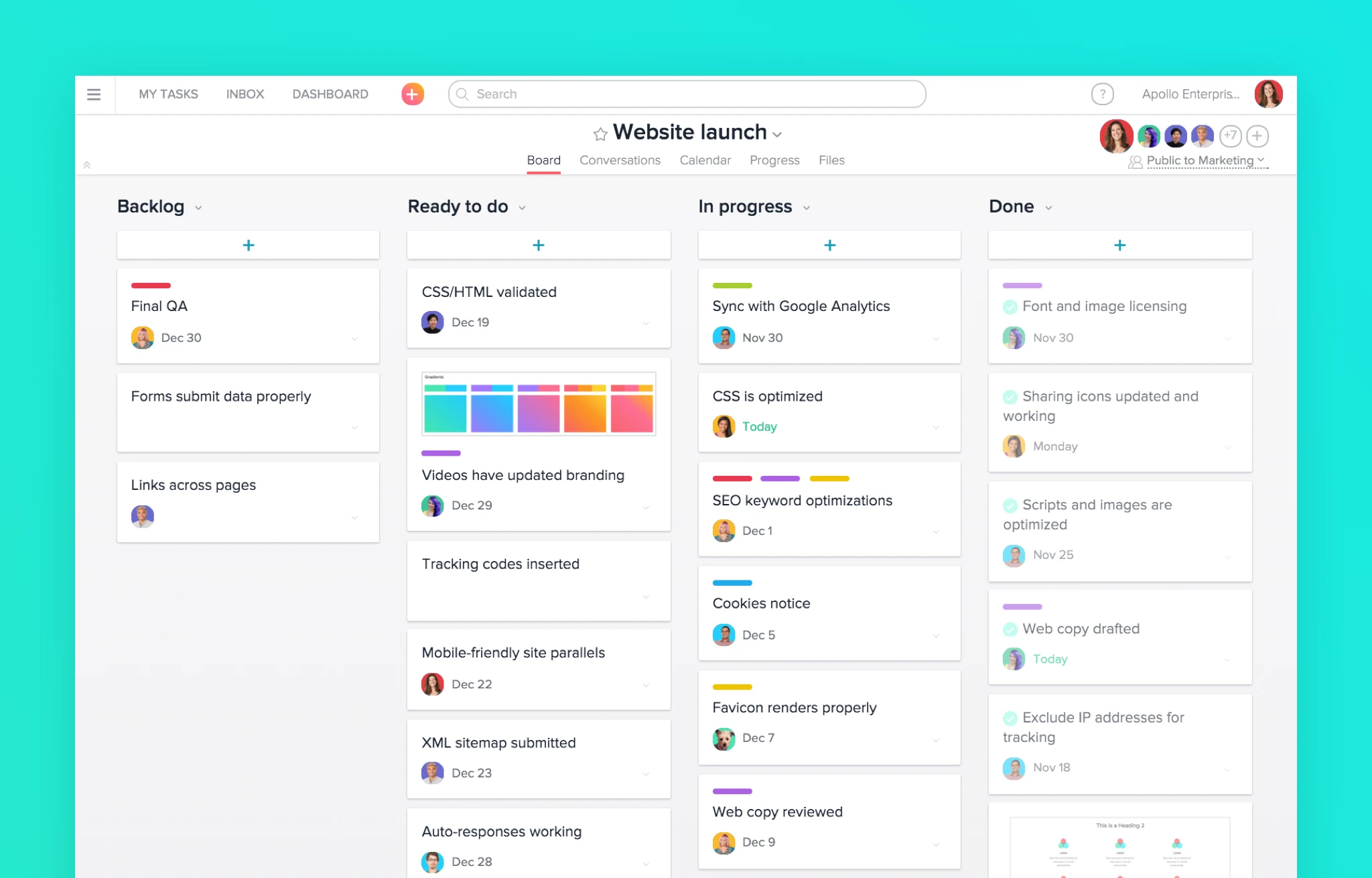

7 Alternatives to Asana for Project and Task Management

Nov 26, 2023

The Complete Guide to Time Blocking with Google Calendar

Nov 25, 2023

Top 10 Daily Planner Apps for Keeping You Organized and On Schedule

Nov 25, 2023

Syncing Asana Tasks to Your Google Calendar: A Step-by-Step Guide

Nov 23, 2023

How to Integrate Todoist with Google Calendar for Seamless Task Management

Nov 19, 2023

Integrate ClickUp with Google Calendar

Nov 14, 2023

Team Planning: Unlocking the Benefits for Your Business

Nov 11, 2023

What features does Planyway for Trello offer?

Oct 5, 2023

Boost Your Productivity with a Weekly P L: A Simplified Task Planning Solution

Oct 5, 2023

Team Planning: The key to Business Success

Oct 4, 2023

How can I sync my Todoist tasks with my Google Calendar?

Oct 2, 2023

Asana Sync with Google Calendar: Streamlining Your Task Management

Sep 3, 2023

How to Sync Asana with Google Calendar: Boost Your Productivity

Sep 3, 2023

Todoist and Google Calendar: The Perfect Productivity Pair

Sep 2, 2023

Todoist Integration with Google Calendar: Streamline Your Task Management

Sep 2, 2023

Exploring the Power of Todoist Calendar View

Sep 1, 2023

Understanding and Overcoming Task Blockers: Boosting Productivity

Sep 1, 2023

Optimize Your Productivity with Time Blocking: Unlocking the Power of Efficient Planning

Aug 31, 2023

Enhancing User Engagement with Motion AI: A New Era of Chatbot Experiences

Aug 31, 2023

Understanding the Motions Calendar in Legal Proceedings

Aug 30, 2023

Maximizing Productivity with the Time Blocking Planner App

Aug 30, 2023

The Ultimate Guide to Streamlining Your Tasks with Trello Planner

Aug 29, 2023

Repeating Tasks: Enhancing Productivity and Efficiency

Aug 29, 2023

Trello Discount Codes for Enhanced Productivity

Aug 28, 2023

The Evolution and Significance of Calendars: Tracking Time Through the Ages

Aug 28, 2023

Maximizing Productivity and Efficiency with a Planner Featuring 15-Minute Time Slots

Aug 27, 2023

Time Blocking vs. To-Do Lists: Finding Your Productivity Strategy

Aug 27, 2023

Enhance Your Trello Experience with Planyway: A Comprehensive Overview

Aug 26, 2023

Exploring Planyway: A Comprehensive Project Management Solution

Aug 26, 2023

Streamline Your Schedule with Planyway Calendar

Aug 25, 2023

How to Sync Google Calendar with Trello

Aug 25, 2023

Blocks of Time: The Key to Effective Time Management

Aug 24, 2023

Exploring the Power Duo: Enhancing Productivity with Google Calendar and Todoist

Aug 24, 2023

Time Blocking in Google Calendar: Boost Your Productivity and Master Your Schedule

Aug 23, 2023

Task Blocking: Understanding the Productivity Pitfall and Overcoming It

Aug 23, 2023

A Comprehensive Guide to Weekly Profit and Loss Statements

Aug 22, 2023

Maximizing Productivity with Todoist Time Blocking

Aug 22, 2023

Discover the Power of Day Blocking: A Productivity Strategy

Aug 21, 2023

How to Sync Trello Calendar with Google Calendar

Aug 21, 2023

Quickly Connect Google Calendar to Trello

Aug 19, 2023

How to Link Trello to Google Sheets: Streamlining Your Workflow

Aug 18, 2023

Streamline Your Workflow: Sync Trello Cards to Google Calendar Events

Aug 17, 2023

Streamlining Your Workflow: Trello + Google Tasks Integration

Aug 16, 2023

Can I Import My Google Calendar to Trello?

Aug 15, 2023

Use Google Calendar for Effective Scheduling

Aug 14, 2023

Mastering Task Duration in Google Calendar: A Comprehensive Guide

Aug 13, 2023

The Power of Calendar Planning Apps: Streamlining Your Life Like Never Before

Aug 12, 2023

Simplify Your Life with Google Calendar Sync

Aug 11, 2023

Creating an Effective Day Schedule: A Path to Productivity and Well-Being

Aug 10, 2023

Maximizing Productivity and Efficiency with Time Blocking

Aug 9, 2023

Google Calendar: A Modern Tool for Efficient Time Management

Aug 8, 2023

Top 10 Daily Planner Apps to Boost Productivity

Aug 7, 2023

Calendly Alternatives & Competitors for 2023

Aug 6, 2023

How to Share Google Calendar: A Step-by-Step Guide

Aug 5, 2023

Best Trello Board Templates: Boost Your Productivity and Organization

Aug 4, 2023

Trello Templates: Enhancing Personal Productivity

Aug 3, 2023

Trello Templates: Simplify Your Workflow and Boost Productivity

Aug 2, 2023

How to Sync Trello with Google Calendar

Aug 1, 2023

How to Link Trello with Google Calendar

Jul 31, 2023

How to Sync Trello and Google Calendar: Enhance Your Productivity and Organization

Jul 30, 2023

Time Blocking with Trello: Boosting Productivity and Organizing Your Life

Jul 29, 2023

TaskPlanner: Your Ultimate Tool for Efficient Task Management

Jul 28, 2023

Trello Google Calendar 2-Way Sync: Streamlining Your Workflow

Jul 27, 2023

Can Trello Sync with Google Calendar?

Jul 26, 2023

Trello Task Management Templates: Streamline Your Workflow Like Never Before

Jul 25, 2023

Clockwise Alternatives: Embracing Productivity and Efficiency

Jul 23, 2023

Google Calendar Daily Schedule: How to Organize Your Life with Efficiency and Ease

Jul 22, 2023

Weekly Planner with Google Calendar: Stay Organized and Efficient

Jul 21, 2023

Top Trello Marketing Templates: Boost Your Marketing Efforts and Drive Results

Jun 6, 2023

Top Trello Project Management Templates: Streamline Your Workflow for Success

May 29, 2023

Top Reasons to Use Trello for Project Management: Boost Your Team's Productivity

May 29, 2023

Why Google Calendar to Trello Sync is the Ultimate Power Move for Productivity

May 20, 2023

Connect google calendar to trello

May 12, 2023

Optimize Your Schedule: Unlock the Power of Google Calendar and Trello Sync with Taskplanner

May 10, 2023

Top trello power ups

May 7, 2023

Chatsonic

May 7, 2023

Explore ChatGPT Alternatives: Empower Your Conversations with AI-Powered Tools

May 7, 2023

Discover Clockwise Alternatives: Take Control of Your Time and Boost Productivity

May 7, 2023

Sync Trello with Google Calendar: Boost Productivity with Task Planner

May 6, 2023

Beyond Google Calendar: Alternative Options and Enhancements for Efficient Scheduling

May 5, 2023

The Ultimate Guide to Trello Google Calendar Sync: Streamline Your Workflow

May 3, 2023

Mastering Your Time with Time Blocking: The Ultimate Productivity Technique

Apr 28, 2023

Motion alternatives

Apr 28, 2023

Why Taskplanner better than Reclaim

Apr 26, 2023

How to remember goals and todo

Apr 26, 2023

Why Taskplanner better than Motion

Apr 26, 2023

Taskplanner and Trello integration

Apr 24, 2023

Reclaim alternative

Apr 22, 2023

Task Planning and Task planner

Apr 22, 2023

Google Calendar app and alternatives

Apr 5, 2023

Taskplanner vs Motion

Apr 19, 2023

Use a calendar to manage your plans and increase productivity

Apr 8, 2022

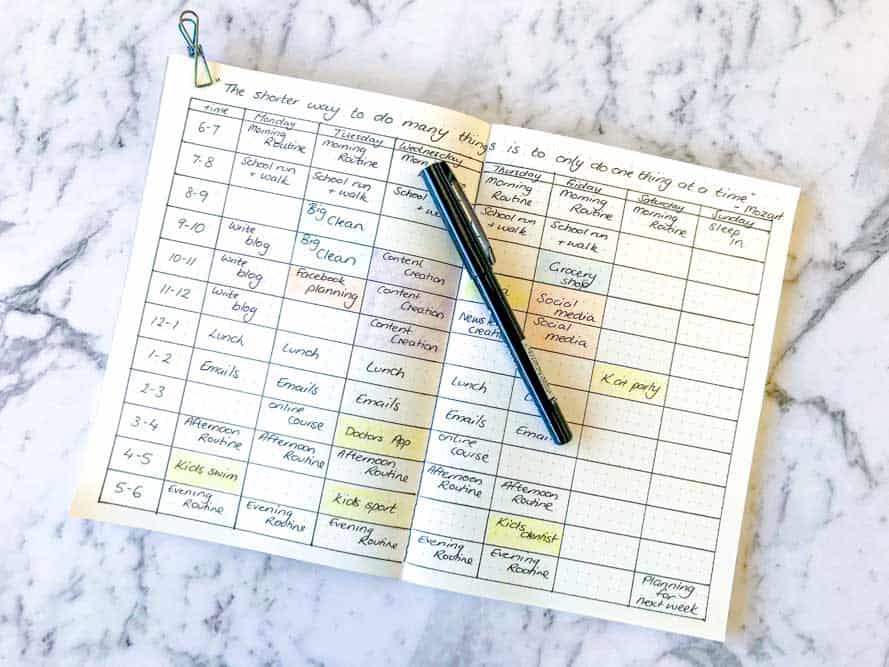

The time slots approach

Mar 15, 2022

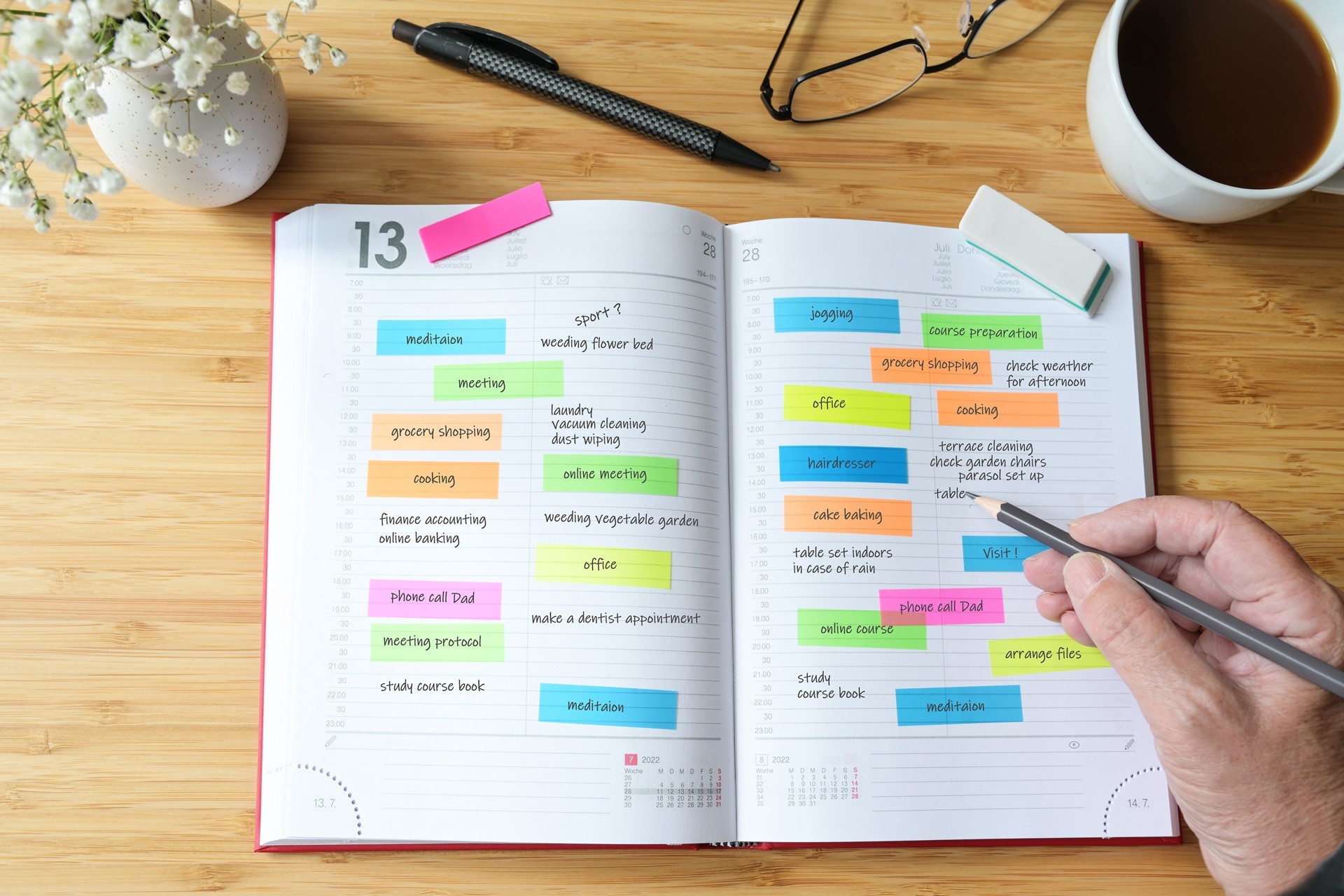

Time management tools

Feb 28, 2022

How to prioritize tasks

Feb 6, 2022

How to Create an Effective Design Portfolio

Jan 12, 2022