Boost Your Productivity with a Weekly P L: A Simplified Task Planning Solution

Oct 5, 2023

What is a weekly P&L?

A weekly P&L, also known as a weekly Profit and Loss statement, is a financial report that provides a summary of a company's revenues, costs, and expenses for a specific week. It helps businesses track their financial performance on a weekly basis and assess their profitability.

The P&L statement typically includes the following components:

1. Revenue: This section lists the total income generated by the company during the week. It includes sales, fees, and any other sources of income.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or delivering the company's products or services. It includes materials, labor, and other expenses directly related to production.

3. Gross Profit: Gross profit is calculated by deducting the COGS from the revenue. It represents the profit generated before deducting operating expenses.

4. Operating Expenses: This section includes all the expenses incurred in running the day-to-day operations of the business. It may include salaries, rent, utilities, advertising, and other overhead costs.

5. Net Profit/Loss: Net profit is the final figure obtained by deducting the operating expenses from the gross profit. It shows the company's overall profitability for the week.

A weekly P&L statement is crucial for businesses as it helps them monitor their financial performance in a shorter time frame. It allows them to identify any trends or issues that need to be addressed promptly. By analyzing the P&L on a weekly basis, businesses can make informed decisions

What information is included in a weekly P&L?

A weekly Profit and Loss statement (P&L) typically includes essential financial data that provides insight into a business's revenue, expenses, and overall profitability for a specific week. Here are the key components typically included in a weekly P&L:

1. Revenue: This section encompasses all the income generated by the business during the week. It includes sales revenue, service fees, and any other sources of income.

2. Cost of Goods Sold (COGS): COGS refers to the direct costs associated with producing or delivering goods or services. It includes raw materials, production costs, and direct labor. Subtracting COGS from revenue gives the gross profit.

3. Gross Profit: This figure represents the profit made after accounting for the direct costs of producing goods or services. It indicates the profitability of the core business operations.

4. Operating Expenses: Operating expenses include all the costs incurred to run the business, such as rent, utilities, salaries, marketing expenses, and administrative costs. These expenses are subtracted from gross profit to calculate the operating profit.

5. Operating Profit: This is the profit earned from the core business operations, excluding non-operating items such as interest and taxes. It helps assess the profitability of the business's day-to-day operations.

6. Non-operating Items: This section includes any income or expenses not directly related to the core business operations. Examples may include interest earned on investments or interest paid on loans.

7. Net Profit: Also known as the bottom line or net

How can a weekly P&L be used to improve performance?

A weekly Profit and Loss (P&L) statement can be a powerful tool for improving performance in a business. This financial statement provides an overview of a company's revenues, costs, and expenses during a specific week, allowing businesses to analyze their financial performance on a regular basis. Here are several ways a weekly P&L can be used to enhance performance:

1. Identifying trends: By reviewing weekly P&L statements, businesses can track trends in their revenues and expenses. This allows them to identify patterns and make more informed decisions. For example, if a company notices a consistent increase in a particular expense, they can investigate the cause and take corrective actions to improve efficiency.

2. Setting goals and targets: A weekly P&L statement helps businesses set realistic goals and targets. By analyzing past performance, companies can identify areas for improvement and set specific financial targets for each week. This can motivate teams to work towards these goals, boosting performance and productivity.

3. Managing cash flow: Cash flow management is crucial for any business. A weekly P&L statement enables companies to monitor their cash inflows and outflows regularly. By identifying any cash flow issues early on, businesses can take proactive measures, such as adjusting spending or seeking additional funding, to maintain a healthy cash flow.

4. Evaluating cost control measures: With a weekly P&L statement, businesses can closely monitor their expenses and evaluate the effectiveness of cost control measures. By comparing actual expenses with budgeted amounts, companies can identify

How is a weekly P&L different from a monthly or annual one?

A weekly P&L (Profit and Loss) statement is different from a monthly or annual one in terms of the time frame it covers. While monthly and annual P&L statements focus on a longer period, a weekly P&L provides a snapshot of a company's financial performance within a specific week.

The main advantage of a weekly P&L is that it allows businesses to track their financial progress on a more frequent basis. By analyzing the revenue and expenses incurred within a single week, companies can identify any trends or patterns that may emerge. This gives them the opportunity to make timely adjustments or strategic decisions to improve their overall financial performance.

Additionally, a weekly P&L offers a more detailed view of a company's financial health compared to its monthly or annual counterparts. It enables businesses to closely monitor their cash flow, identify any discrepancies or issues, and take appropriate steps to rectify them. This level of granularity helps businesses stay on top of their finances and make informed decisions to optimize profitability.

Furthermore, a weekly P&L provides a more agile approach to financial planning and forecasting. By reviewing financial data on a weekly basis, businesses can quickly adapt their strategies and allocate resources accordingly. This flexibility allows them to respond to market changes, adjust their goals, and effectively manage their financial resources.

In summary, a weekly P&L differs from a monthly or annual one in terms of the time frame it covers and the level of detail it provides. While monthly and annual P&L statements offer a broader

What information is included in a weekly P&L?

A weekly Profit and Loss (P&L) statement provides valuable information about the financial performance of a business over a specific week. It includes several key components that help assess the profitability and financial health of the company. Here are the main sections typically included in a weekly P&L:

1. Revenue: This section details the total sales or income generated by the business during the week. It includes all sources of revenue, such as product sales, service fees, and any other income streams.

2. Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing or delivering the goods or services sold during the week. It includes expenses like raw materials, direct labor, and manufacturing costs.

3. Gross Profit: Gross profit is calculated by subtracting the COGS from the revenue. It indicates the profitability of the core business operations and provides a measure of how efficiently the business converts sales into profits.

4. Operating Expenses: This section includes all the regular operating expenses incurred by the business during the week. It covers costs like rent, utilities, salaries, marketing expenses, and any other expenses necessary to run the business.

5. Operating Income: Operating income is obtained by subtracting the operating expenses from the gross profit. It shows the profit generated from the core business operations before considering non-operating income or expenses.

6. Non-Operating Income/Expenses: This section includes any income or expenses that are not directly related to the core business operations. It can include interest income

What are the benefits of creating a weekly P&L?

Creating a weekly Profit and Loss (P&L) statement can provide numerous benefits for businesses and teams. Here are some key advantages:

1. Financial visibility: A weekly P&L statement allows businesses to gain a clear understanding of their financial health on a regular basis. It provides a snapshot of revenue, expenses, and net income for the week, enabling businesses to track their financial performance and make informed decisions.

2. Timely insights: By analyzing a weekly P&L, businesses can quickly identify any fluctuations or trends in their income and expenses. This helps them spot potential issues or opportunities early on and take appropriate action to address them.

3. Better decision-making: With a weekly P&L, businesses have access to up-to-date financial information, allowing them to make more informed decisions. They can assess the impact of different strategies, investments, or cost-cutting measures on their profitability, and adjust their plans accordingly.

4. Goal tracking: A weekly P&L statement helps businesses track their progress towards financial goals. By comparing actual results with budgeted or target figures, businesses can assess their performance and take corrective actions if necessary. This enables them to stay focused and accountable for meeting their financial objectives.

5. Improved cash flow management: Since a weekly P&L statement provides insights into revenue and expenses, businesses can effectively manage their cash flow. They can identify any cash flow gaps or surpluses and take appropriate steps, such as adjusting payment terms or managing expenses, to ensure a healthy

What is the purpose of a weekly P&L?

A weekly P&L, or profit and loss statement, serves the purpose of providing a snapshot of a company's financial performance over a specific week.

The primary goal of a weekly P&L is to track and analyze the revenue, expenses, and profitability of a business on a regular basis. It allows businesses to understand their financial health, identify trends, and make informed decisions to drive growth and maximize profitability.

By reviewing the weekly P&L, businesses can monitor their revenue streams, identify any changes or fluctuations, and assess the impact of various factors on their bottom line. It helps business owners and managers to identify areas of inefficiency, control costs, and implement strategies to improve profitability.

Furthermore, a weekly P&L provides a reliable way to track progress towards financial goals and objectives. It helps businesses to stay accountable, make adjustments, and take proactive measures to achieve their targets. It also serves as a tool for communication and transparency, as it allows stakeholders, investors, and lenders to assess the financial performance of the business regularly.

In summary, the purpose of a weekly P&L is to provide a comprehensive overview of a company's financial performance, enable informed decision-making, and drive profitability. It is a vital component of financial management and planning for businesses of all sizes.

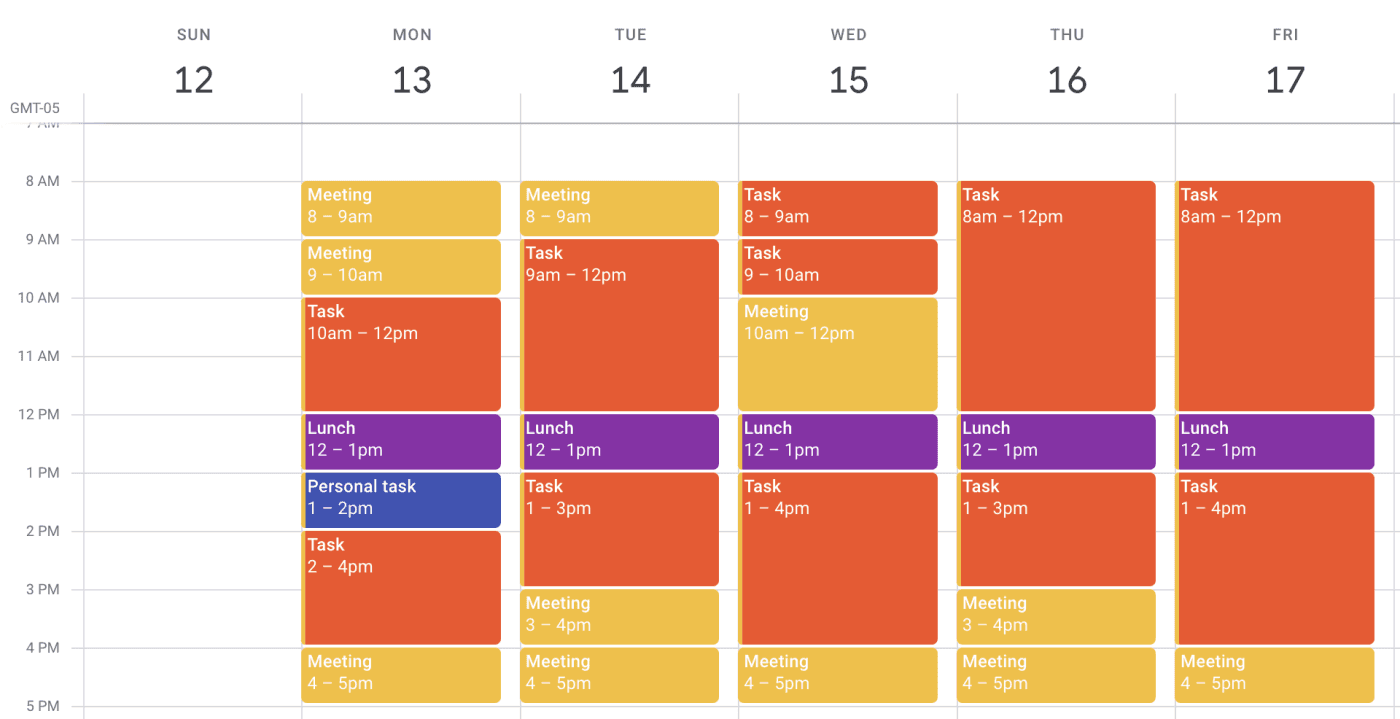

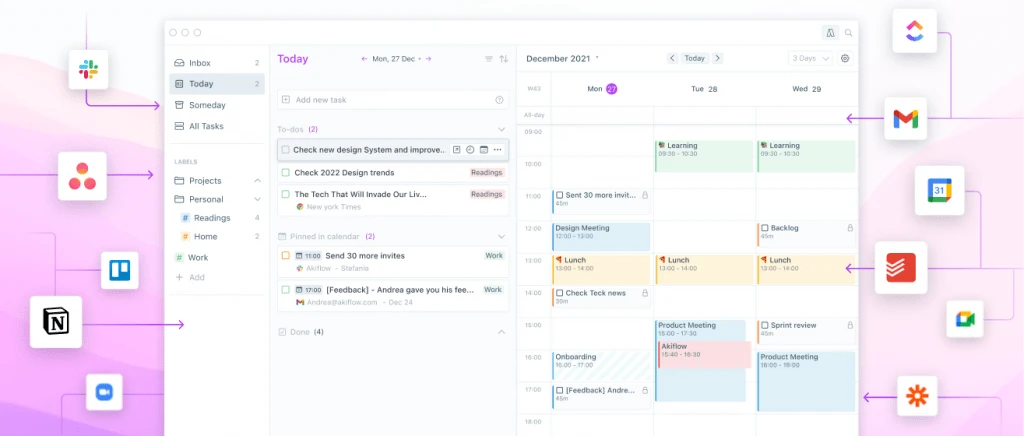

Your Trello, Asana, ClickUp, Todoist tasks

on Google Calendar.

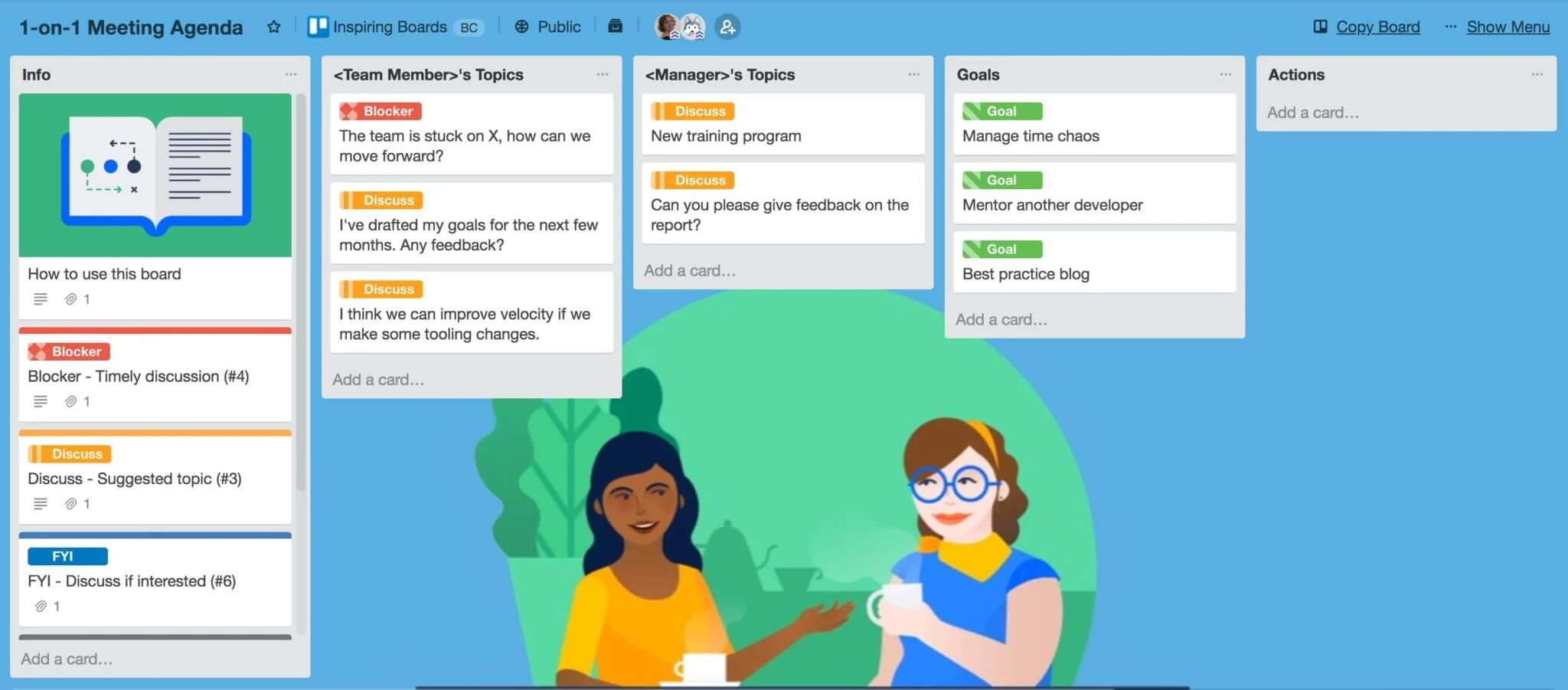

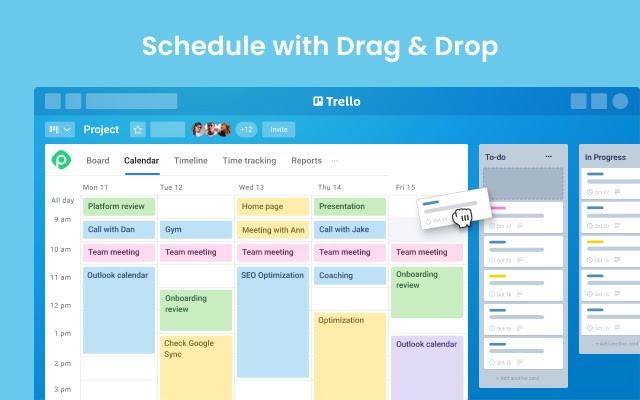

Visualizing Goals: Trello Boards for Long-Term Work Week Planning

Jan 1, 2024

Automation Hacks: Trello Integrations for Streamlined Workflows

Dec 31, 2023

Collaborative Planning: Enhancing Team Productivity with Trello Boards

Dec 30, 2023

Task Prioritization: Trello Strategies for a Productive Work Week

Dec 29, 2023

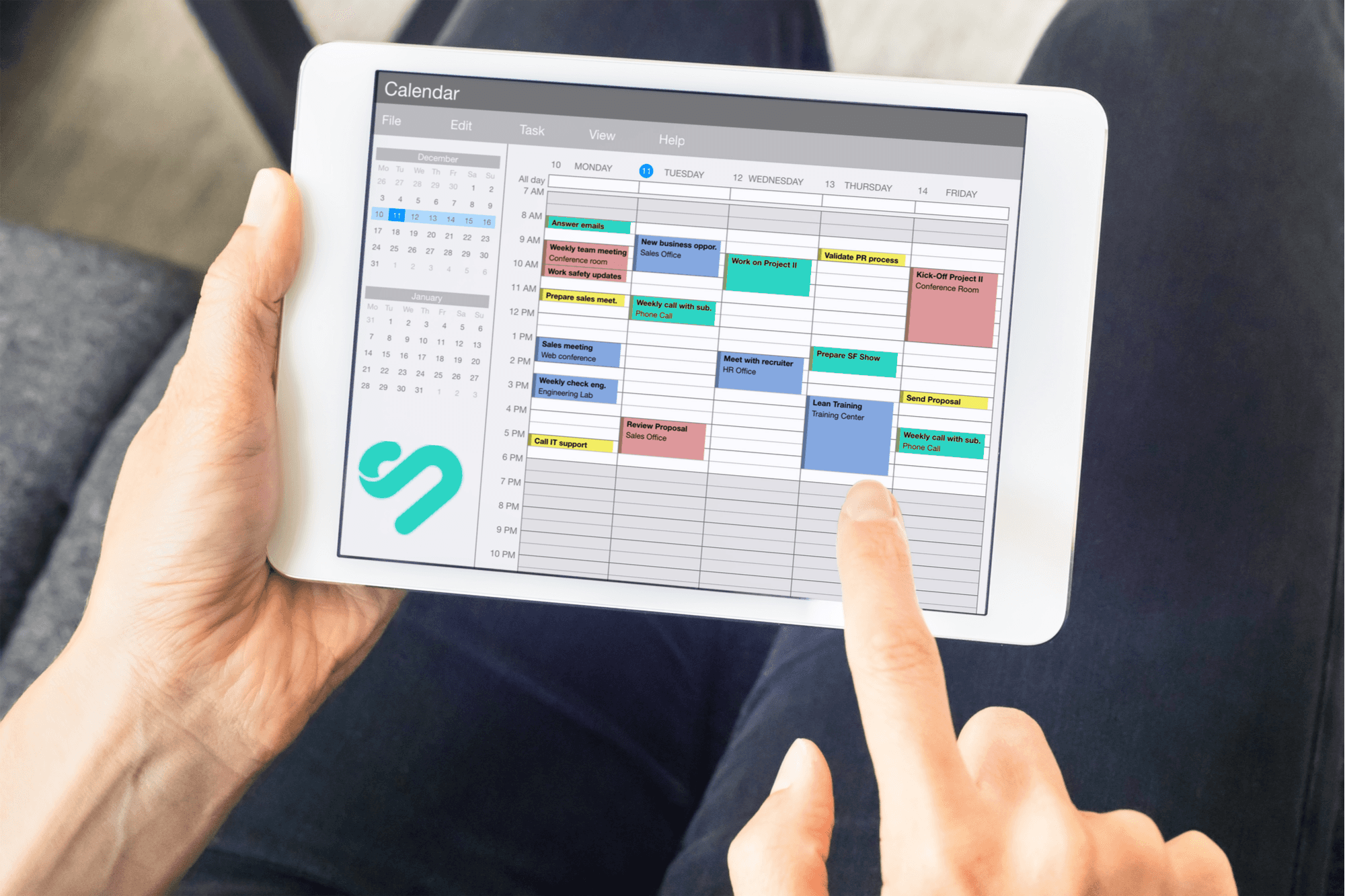

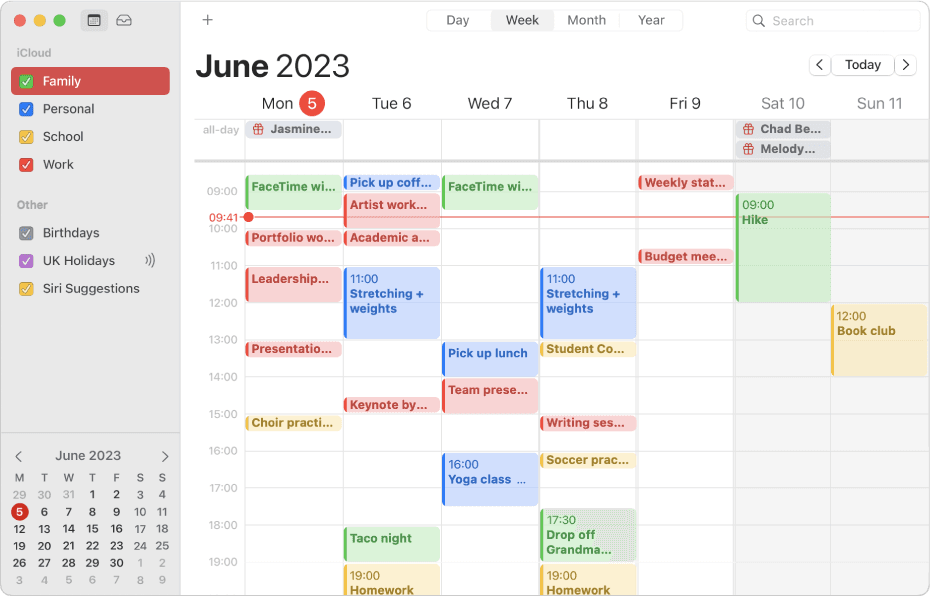

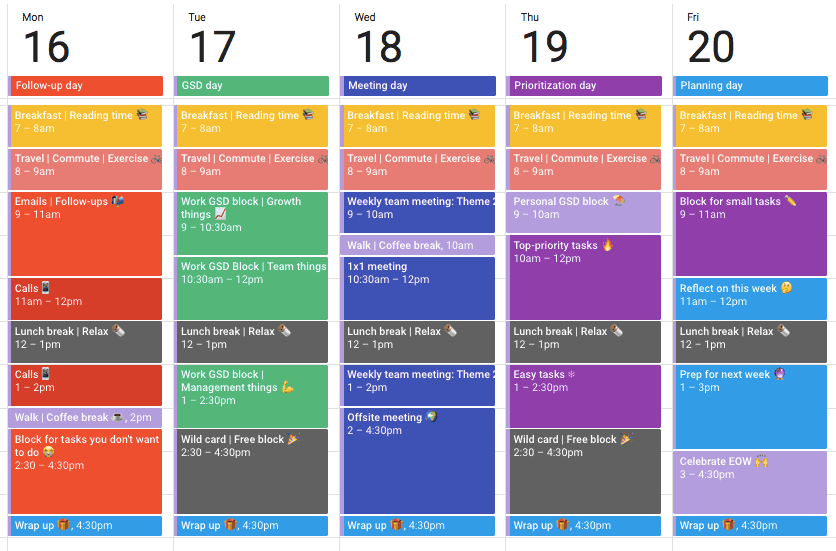

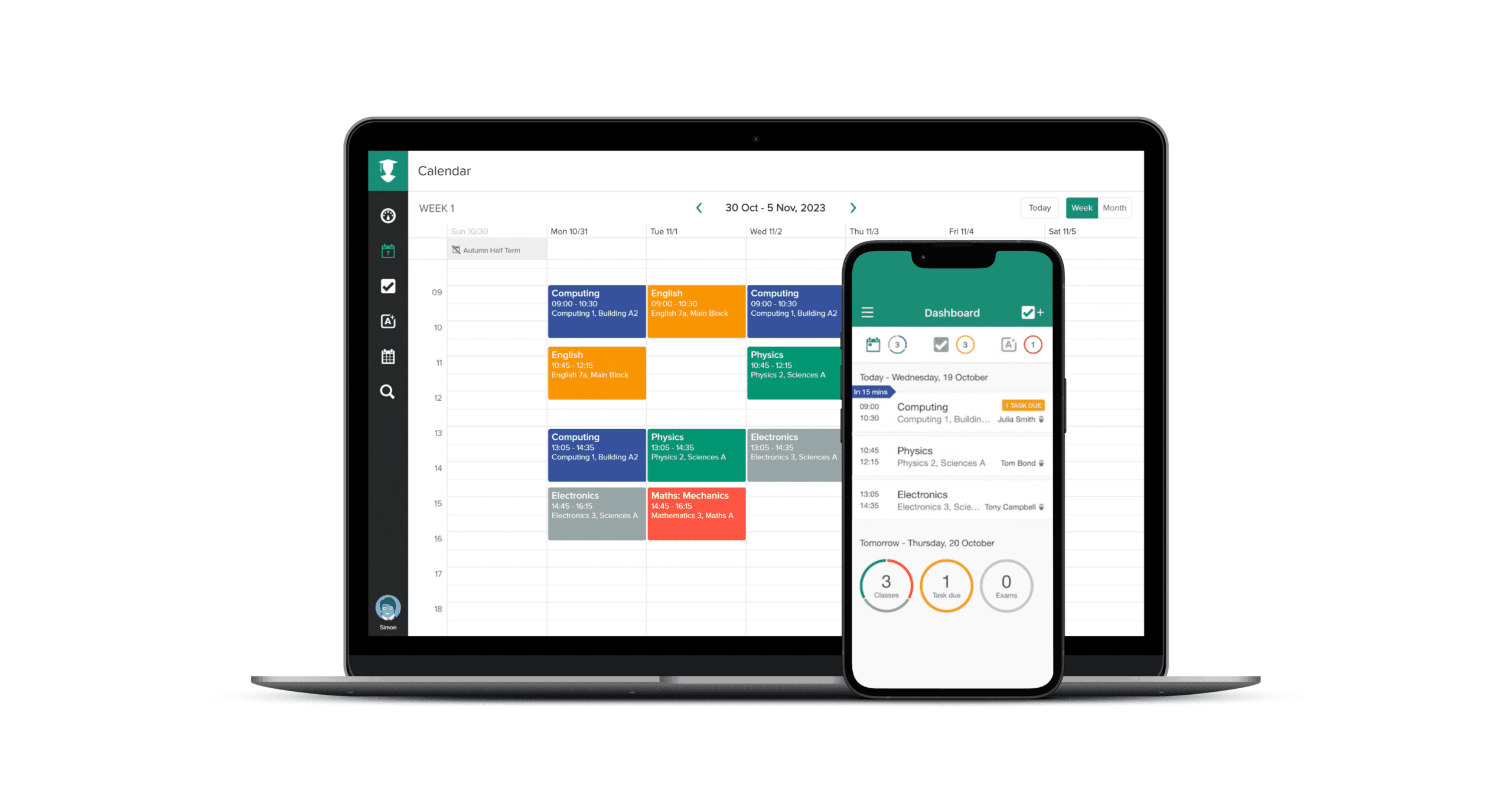

From Goals to Reality: Long-Term Planning with Google Calendar and Time Blocking

Dec 24, 2023

Optimizing Your Schedule: Google Calendar Apps for Enhanced Time Blocking

Dec 23, 2023

Collaborative Time Blocking: Using Google Calendar for Team Productivity

Dec 22, 2023

Balancing Work and Life: Time Blocking Strategies for Personal and Professional Harmony

Dec 21, 2023

Time Blocking for Productivity: Google Calendar Tips and Tricks

Dec 20, 2023

Mastering Your Time: A Comprehensive Guide on How to Use Google Calendar for Time Blocking

Dec 19, 2023

Advanced Customizations: Asana and Google Calendar for Power Users

Dec 15, 2023

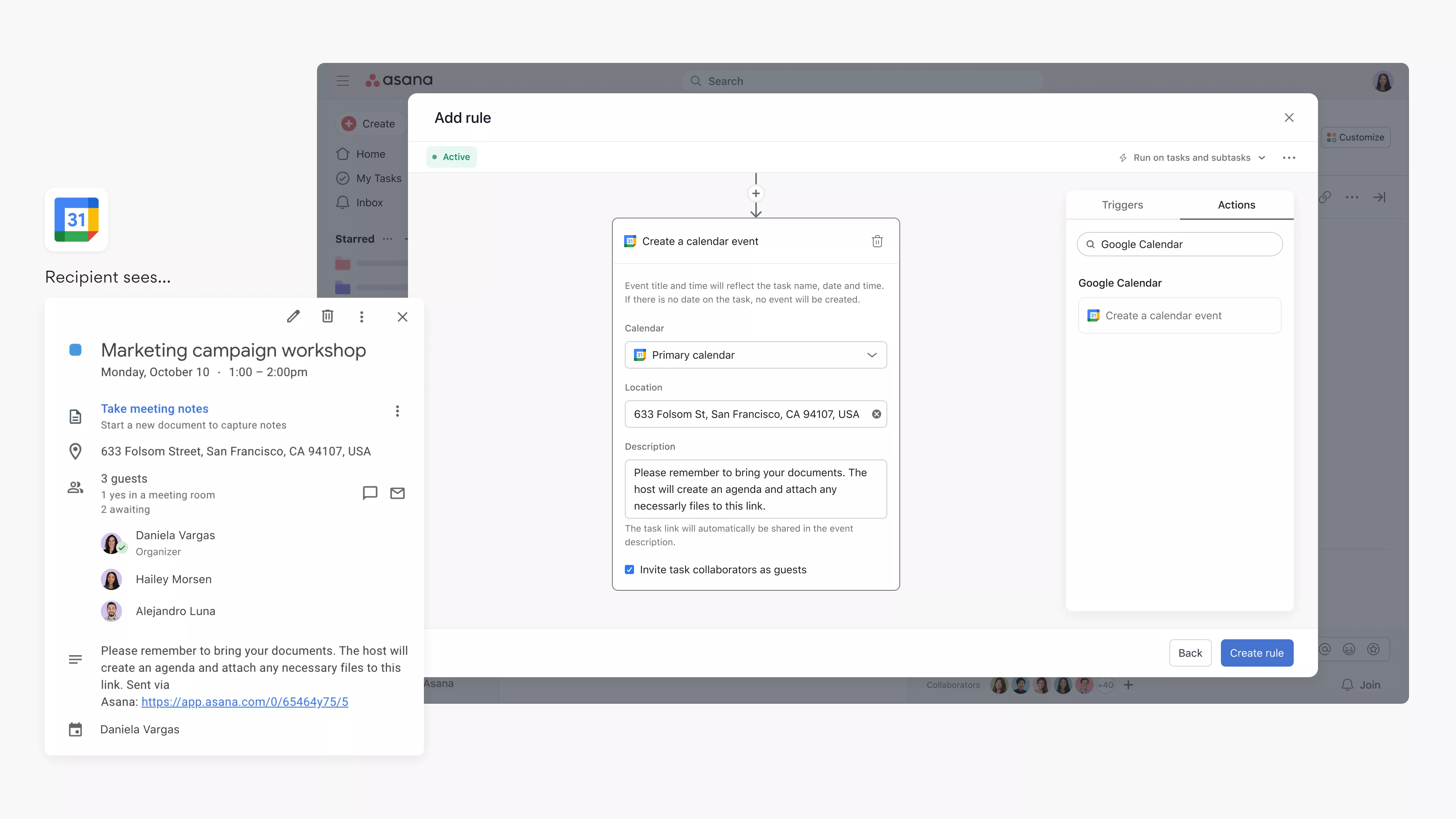

Automation Hacks: Asana Integrations and Google Calendar Efficiency

Dec 14, 2023

Team Collaboration Made Easy: Asana Projects and Google Calendar Events

Dec 13, 2023

Time Blocking Techniques: Asana Tasks and Google Calendar Synergy

Dec 12, 2023

Syncing Asana Due Dates with Google Calendar: A Comprehensive Tutorial

Dec 11, 2023

Advanced Customizations: Trello and Google Calendar for Power Users

Dec 10, 2023

Collaborative Project Planning: Trello Teams and Google Calendar Events

Dec 9, 2023

Time Management Strategies: Trello Boards and Google Calendar Harmony

Dec 8, 2023

Syncing Trello Cards with Google Calendar: A Step-by-Step Tutorial

Dec 7, 2023

Task Prioritization Strategies: A Todoist and Google Calendar Approach

Dec 6, 2023

Unlock Your Productivity with Advanced Features for Todoist and Google Calendar Power Users

Dec 5, 2023

Using Todoist and Google Calendar for Effective Collaborative Planning in Teams

Dec 4, 2023

Using Time Blocking with Todoist and Google Calendar to Enhance Productivity

Dec 3, 2023

Using Labels and Filters: Todoist and Google Calendar Synergy

Dec 2, 2023

How to Sync Todoist Tasks to Google Calendar Events

Dec 1, 2023

Integrating Todoist with Google Calendar for Effortless Scheduling

Nov 30, 2023

7 Free Trello Templates for Streamlining Workflow and Improving Productivity

Nov 29, 2023

Setting Goals that Motivate and Inspire Action

Nov 28, 2023

How to Integrate Todoist with Apple Calendar for Increased Productivity

Nov 27, 2023

7 Alternatives to Asana for Project and Task Management

Nov 26, 2023

The Complete Guide to Time Blocking with Google Calendar

Nov 25, 2023

Top 10 Daily Planner Apps for Keeping You Organized and On Schedule

Nov 25, 2023

Syncing Asana Tasks to Your Google Calendar: A Step-by-Step Guide

Nov 23, 2023

How to Integrate Todoist with Google Calendar for Seamless Task Management

Nov 19, 2023

Integrate ClickUp with Google Calendar

Nov 14, 2023

Team Planning: Unlocking the Benefits for Your Business

Nov 11, 2023

What features does Planyway for Trello offer?

Oct 5, 2023

Boost Your Productivity with a Weekly P L: A Simplified Task Planning Solution

Oct 5, 2023

Team Planning: The key to Business Success

Oct 4, 2023

How can I sync my Todoist tasks with my Google Calendar?

Oct 2, 2023

Asana Sync with Google Calendar: Streamlining Your Task Management

Sep 3, 2023

How to Sync Asana with Google Calendar: Boost Your Productivity

Sep 3, 2023

Todoist and Google Calendar: The Perfect Productivity Pair

Sep 2, 2023

Todoist Integration with Google Calendar: Streamline Your Task Management

Sep 2, 2023

Exploring the Power of Todoist Calendar View

Sep 1, 2023

Understanding and Overcoming Task Blockers: Boosting Productivity

Sep 1, 2023

Optimize Your Productivity with Time Blocking: Unlocking the Power of Efficient Planning

Aug 31, 2023

Enhancing User Engagement with Motion AI: A New Era of Chatbot Experiences

Aug 31, 2023

Understanding the Motions Calendar in Legal Proceedings

Aug 30, 2023

Maximizing Productivity with the Time Blocking Planner App

Aug 30, 2023

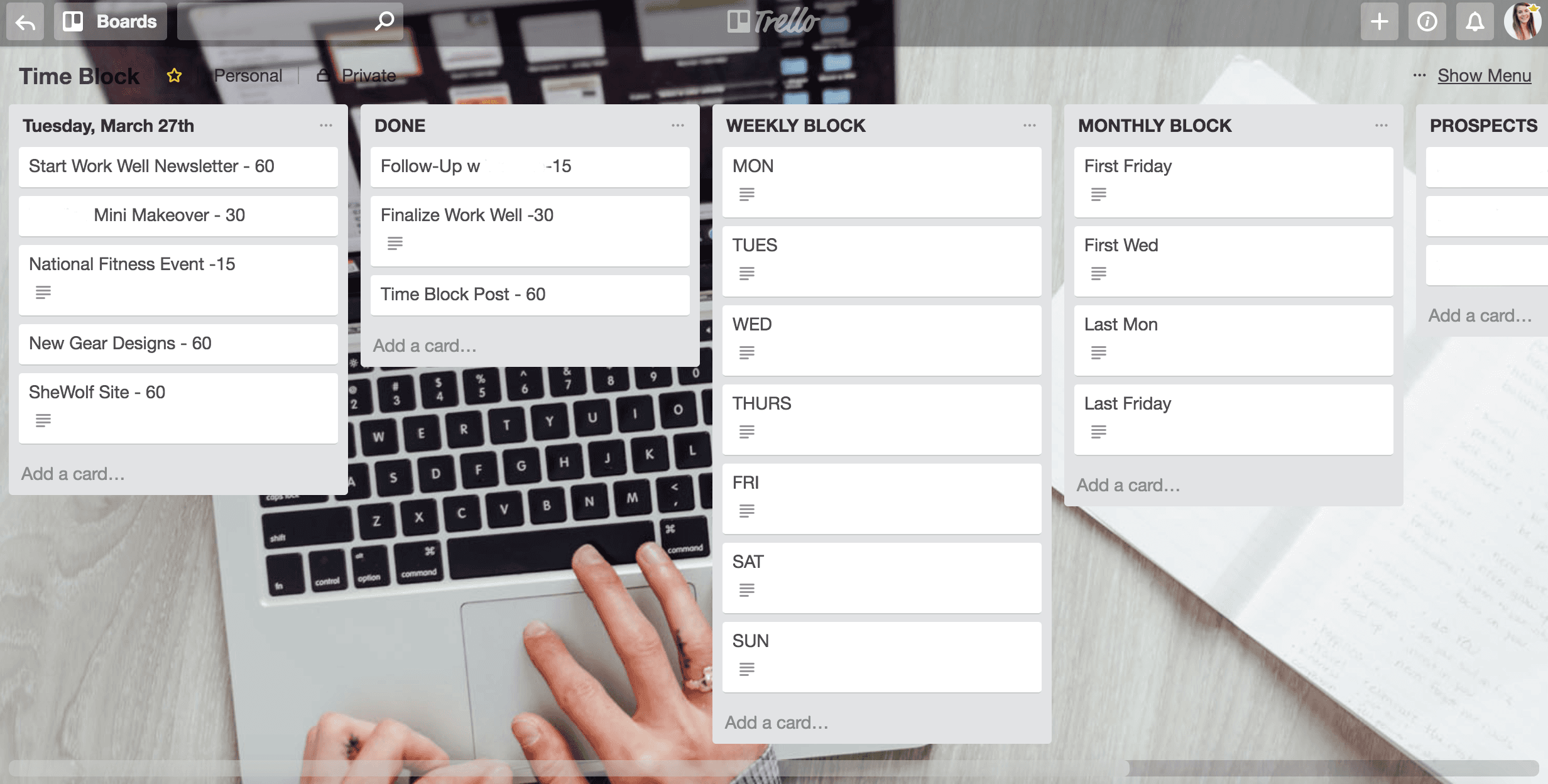

The Ultimate Guide to Streamlining Your Tasks with Trello Planner

Aug 29, 2023

Repeating Tasks: Enhancing Productivity and Efficiency

Aug 29, 2023

Trello Discount Codes for Enhanced Productivity

Aug 28, 2023

The Evolution and Significance of Calendars: Tracking Time Through the Ages

Aug 28, 2023

Maximizing Productivity and Efficiency with a Planner Featuring 15-Minute Time Slots

Aug 27, 2023

Time Blocking vs. To-Do Lists: Finding Your Productivity Strategy

Aug 27, 2023

Enhance Your Trello Experience with Planyway: A Comprehensive Overview

Aug 26, 2023

Exploring Planyway: A Comprehensive Project Management Solution

Aug 26, 2023

Streamline Your Schedule with Planyway Calendar

Aug 25, 2023

How to Sync Google Calendar with Trello

Aug 25, 2023

Blocks of Time: The Key to Effective Time Management

Aug 24, 2023

Exploring the Power Duo: Enhancing Productivity with Google Calendar and Todoist

Aug 24, 2023

Time Blocking in Google Calendar: Boost Your Productivity and Master Your Schedule

Aug 23, 2023

Task Blocking: Understanding the Productivity Pitfall and Overcoming It

Aug 23, 2023

A Comprehensive Guide to Weekly Profit and Loss Statements

Aug 22, 2023

Maximizing Productivity with Todoist Time Blocking

Aug 22, 2023

Discover the Power of Day Blocking: A Productivity Strategy

Aug 21, 2023

How to Sync Trello Calendar with Google Calendar

Aug 21, 2023

Quickly Connect Google Calendar to Trello

Aug 19, 2023

How to Link Trello to Google Sheets: Streamlining Your Workflow

Aug 18, 2023

Streamline Your Workflow: Sync Trello Cards to Google Calendar Events

Aug 17, 2023

Streamlining Your Workflow: Trello + Google Tasks Integration

Aug 16, 2023

Can I Import My Google Calendar to Trello?

Aug 15, 2023

Use Google Calendar for Effective Scheduling

Aug 14, 2023

Mastering Task Duration in Google Calendar: A Comprehensive Guide

Aug 13, 2023

The Power of Calendar Planning Apps: Streamlining Your Life Like Never Before

Aug 12, 2023

Simplify Your Life with Google Calendar Sync

Aug 11, 2023

Creating an Effective Day Schedule: A Path to Productivity and Well-Being

Aug 10, 2023

Maximizing Productivity and Efficiency with Time Blocking

Aug 9, 2023

Google Calendar: A Modern Tool for Efficient Time Management

Aug 8, 2023

Top 10 Daily Planner Apps to Boost Productivity

Aug 7, 2023

Calendly Alternatives & Competitors for 2023

Aug 6, 2023

How to Share Google Calendar: A Step-by-Step Guide

Aug 5, 2023

Best Trello Board Templates: Boost Your Productivity and Organization

Aug 4, 2023

Trello Templates: Enhancing Personal Productivity

Aug 3, 2023

Trello Templates: Simplify Your Workflow and Boost Productivity

Aug 2, 2023

How to Sync Trello with Google Calendar

Aug 1, 2023

How to Link Trello with Google Calendar

Jul 31, 2023

How to Sync Trello and Google Calendar: Enhance Your Productivity and Organization

Jul 30, 2023

Time Blocking with Trello: Boosting Productivity and Organizing Your Life

Jul 29, 2023

TaskPlanner: Your Ultimate Tool for Efficient Task Management

Jul 28, 2023

Trello Google Calendar 2-Way Sync: Streamlining Your Workflow

Jul 27, 2023

Can Trello Sync with Google Calendar?

Jul 26, 2023

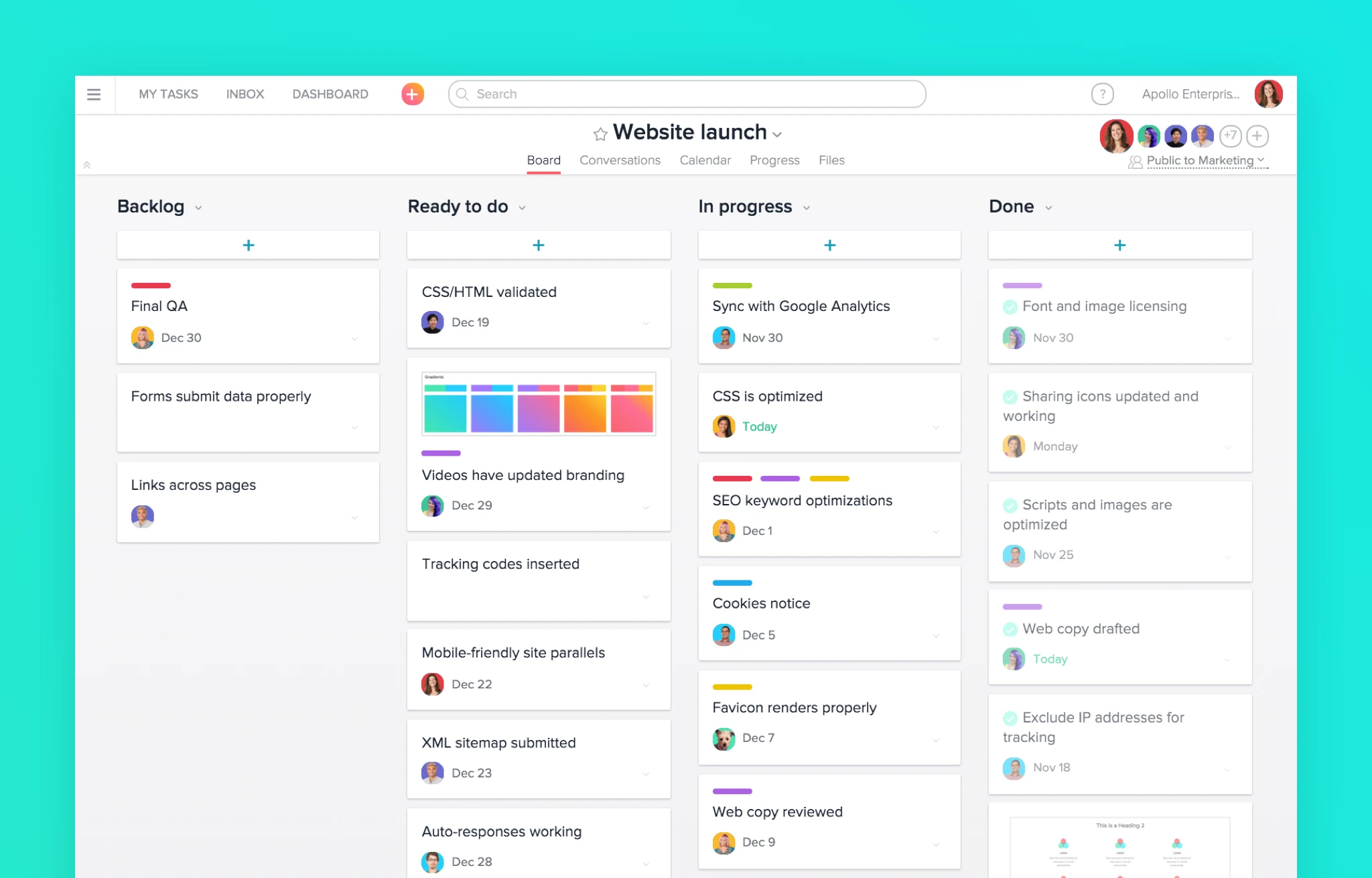

Trello Task Management Templates: Streamline Your Workflow Like Never Before

Jul 25, 2023

Clockwise Alternatives: Embracing Productivity and Efficiency

Jul 23, 2023

Google Calendar Daily Schedule: How to Organize Your Life with Efficiency and Ease

Jul 22, 2023

Weekly Planner with Google Calendar: Stay Organized and Efficient

Jul 21, 2023

Top Trello Marketing Templates: Boost Your Marketing Efforts and Drive Results

Jun 6, 2023

Top Trello Project Management Templates: Streamline Your Workflow for Success

May 29, 2023

Top Reasons to Use Trello for Project Management: Boost Your Team's Productivity

May 29, 2023

Why Google Calendar to Trello Sync is the Ultimate Power Move for Productivity

May 20, 2023

Connect google calendar to trello

May 12, 2023

Optimize Your Schedule: Unlock the Power of Google Calendar and Trello Sync with Taskplanner

May 10, 2023

Top trello power ups

May 7, 2023

Chatsonic

May 7, 2023

Explore ChatGPT Alternatives: Empower Your Conversations with AI-Powered Tools

May 7, 2023

Discover Clockwise Alternatives: Take Control of Your Time and Boost Productivity

May 7, 2023

Sync Trello with Google Calendar: Boost Productivity with Task Planner

May 6, 2023

Beyond Google Calendar: Alternative Options and Enhancements for Efficient Scheduling

May 5, 2023

The Ultimate Guide to Trello Google Calendar Sync: Streamline Your Workflow

May 3, 2023

Mastering Your Time with Time Blocking: The Ultimate Productivity Technique

Apr 28, 2023

Motion alternatives

Apr 28, 2023

Why Taskplanner better than Reclaim

Apr 26, 2023

How to remember goals and todo

Apr 26, 2023

Why Taskplanner better than Motion

Apr 26, 2023

Taskplanner and Trello integration

Apr 24, 2023

Reclaim alternative

Apr 22, 2023

Task Planning and Task planner

Apr 22, 2023

Google Calendar app and alternatives

Apr 5, 2023

Taskplanner vs Motion

Apr 19, 2023

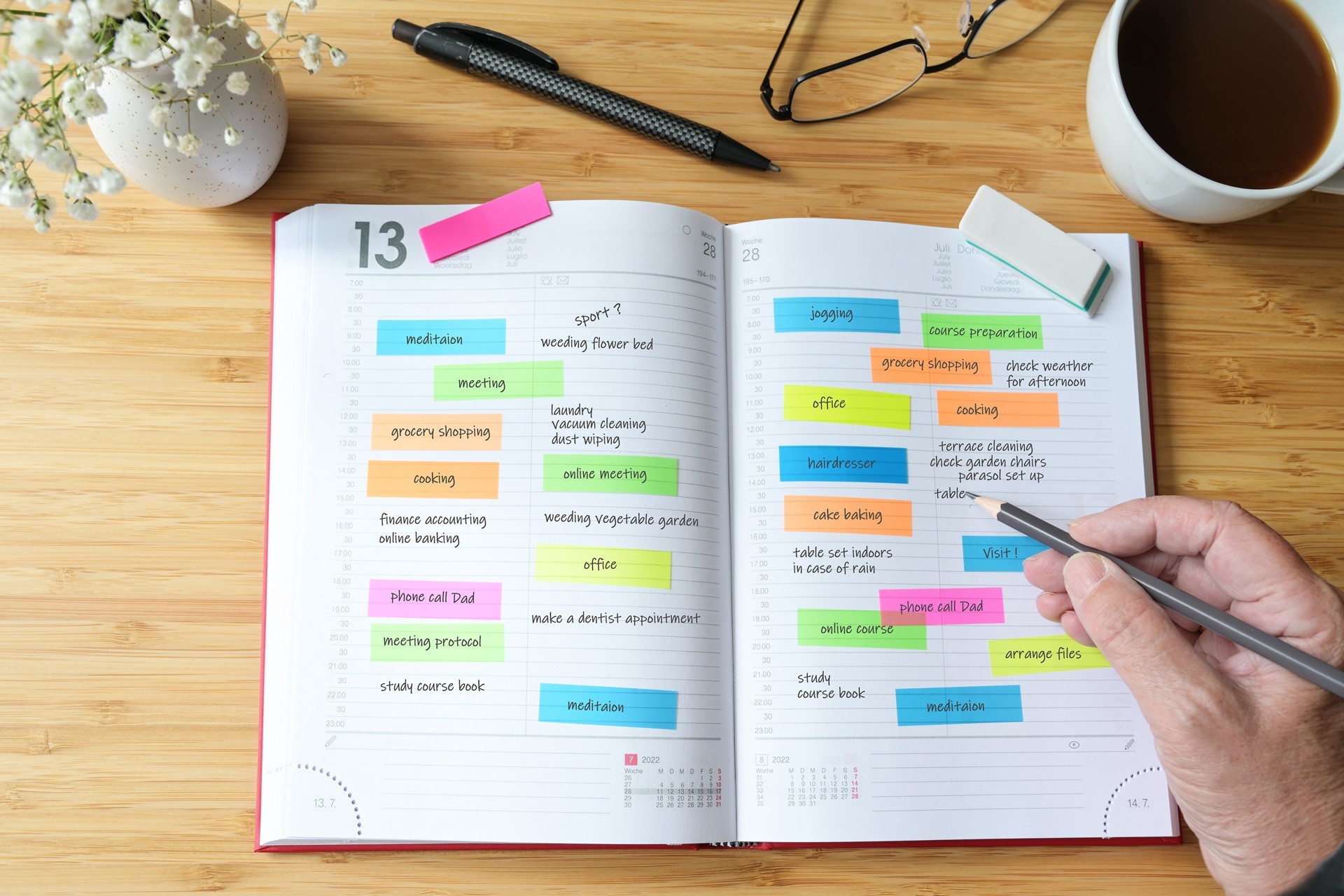

Use a calendar to manage your plans and increase productivity

Apr 8, 2022

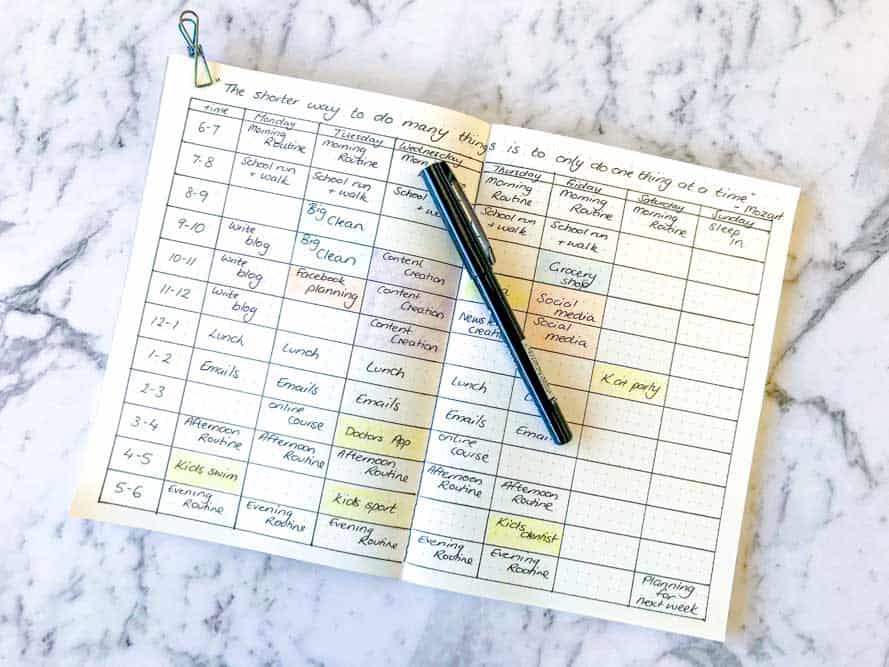

The time slots approach

Mar 15, 2022

Time management tools

Feb 28, 2022

How to prioritize tasks

Feb 6, 2022

How to Create an Effective Design Portfolio

Jan 12, 2022